Financial Management

Managerial accounting is a critical aspect of financial management within organizations. It helps with managerial decision-making through a series of steps in financial information that include:

- Identification

- Measurement

- Analysis

- Interpretation

- Communication

Managerial accounting is commonly referred to as management accounting. It is a vital aspect of financial management to make informed business decisions. Management accounting involves collecting, analyzing, interpreting, planning and budgeting, evaluating business performance, cost analysis and controls, decision-making, accountability and responsibility

Financial Management is the practice of handling a company’s finances in a way that allows it to be successful and compliant with regulations. That takes both a high-level plan and boots-on-the-ground execution.

Financial Management also concerns with profitability, expenses, cash and credit

Objectives of Financial Management

Building on those pillars, financial managers help their companies in a variety of ways, including but not limited to:

- Maximizing profits: Provide insights on, for example, rising costs of raw materials that might trigger an increase in the cost of goods sold.

- Tracking liquidity and cash flow: Ensure the company has enough money on hand to meet its obligations.

- Ensuring compliance: Keep up with industry-specific regulations.

- Developing financial scenarios: These are based on the business current state and forecasts that assume a wide range of outcomes based on possible market conditions.

- Manage relationships: Dealing effectively with investors and the boards of directors.

- Maintaining enough supply of funds for the organization

- Ensuring shareholders of the organization get good returns on their investment

- Optimum and efficient utilization of funds

- Creating real and safe investment opportunities

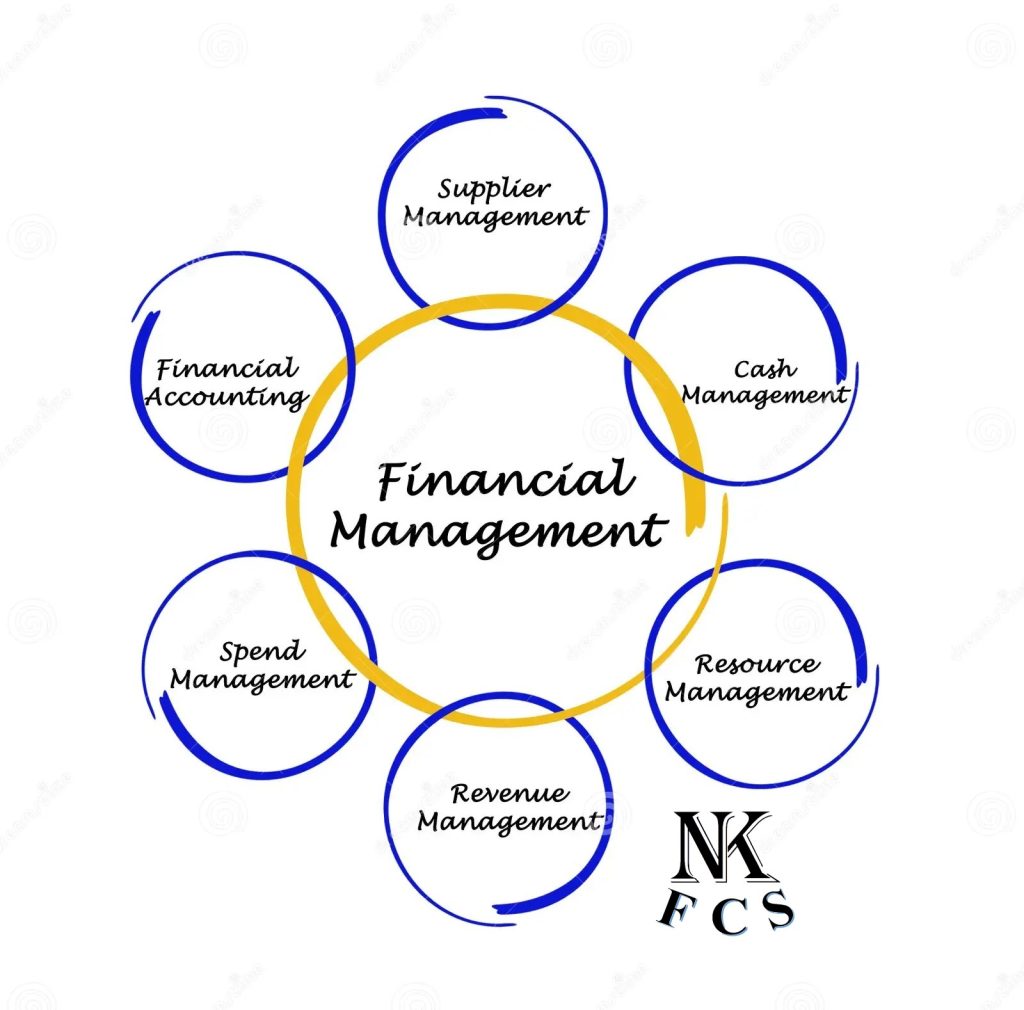

Financial management is also made up of certain elements that include:

- Financial planning: This is the process of calculating the amount of capital that is required by an organization and then determining its allocation. A financial plan includes certain key objectives which are:

Determining the amount of capital required

Determining the capital organization and structure

Framing of the organization’s financial policies and regulations

Financial control: This is one of the key activities in financial management. Its main role is to assess whether an organization is meeting its objectives or not.

Scope of Financial Management

Financial management encompasses four major areas:

Planning

The financial manager projects how much money the company will need in order to maintain positive cash flow, allocate funds to grow or add new products or services and cope with unexpected events, and shares that information with business colleagues. Planning may be broken down into categories including capital expenses, T&E and workforce and indirect and operational expenses.

Budgeting

The financial manager allocates the company’s available funds to meet costs, such as mortgages or rents, salaries, raw materials, employee T&E and other obligations. Budgets may be static or flexible

Managing and Assessing risk

Line-of-business executives look to their financial managers to assess and provide compensating controls for a variety of risks, including: Market Risk, Credit Risk, Liquidity Risk, Operational Risk

Procedures

The financial manager sets procedures regarding how the finance team will process and distribute financial data, like invoices, payments and reports, with security and accuracy.

Functions of Financial Management

More practically, a financial manager’s activities in the above areas revolve around planning and forecasting and controlling expenditures.

The financial planning analysis function includes issuing Profit and Lost (P&L) statements, analyzing which product lines or services have the highest profit margin or contribute the most to net profitability, maintaining the budget and forecasting the company’s future financial performance and scenario planning.

Importance of Financial Management

Solid financial management provides the foundation for three pillars of sound fiscal governance:

- Strategizing

- Decision-making

- Controlling

Three broader types of financial management:

- Capital budgeting

- Capital structure

- Working capital management

Financial management more functions are:

- Calculating the capital required

- Formation of capital structure

- Investing capital

- Allocation of profits

- Effective management of money

- Financial control